1. General introduction

1.1. Definition of public-private partnership (PPP) investment

According to Vietnam's current Investment Law on Public-Private Partnership (PPP) (Law No. 64/2020/QH14), "Public-Private partnership investment (PPP investment) is an investment method that is implemented on the basis of definite-term cooperation between the State and private investors through the signing and performance of PPP project contracts in order to attract private investors to participate in PPP projects” [6]. Investment under the PPP method in construction of transport infrastructure is usually in the form of a Build - Operate - Transfer contract (BOT contract) and a Build - Transfer contract (BT contract).

Investment in construction of transport infrastructure under a BOT contract is understood as a combination of the state and the private sector jointly investing capital in transport infrastructure. Then, the private sector is allowed to do business within a certain period of time to get back such invested capital. At the end of the business term, it will hand over the transport infrastructure to the state.

In the past, investment in transport infrastructure in Vietnam under the Build-Transfer contracts (BT contracts) has also been fairly popular. Investment in the form of BT contract is understood as investors/project enterprises invest in transport infrastructure. When the construction is completed, it will be handed over to the state, paid by the state in cash or in public assets such as land [2].

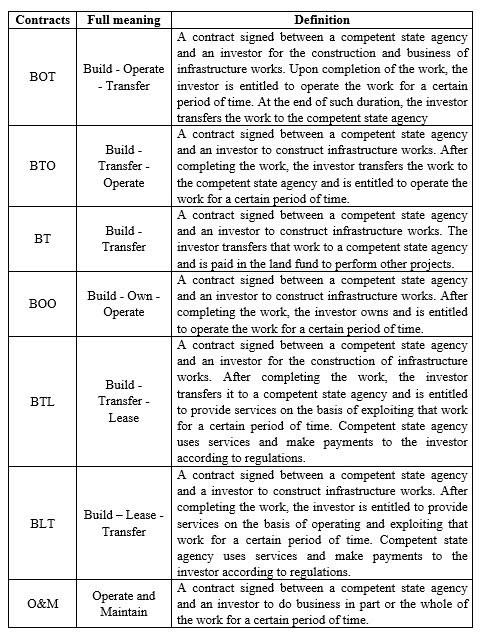

1.2. Types of PPP contracts in Vietnam

Table 1: Types of PPP contracts until 2020

Source: Author compiled from Vietnamese legal regulations on PPP investment up to before Law No. 64/2020 [4]

2. PPP legal system in Vietnam

Investment under the PPP method in Vietnam has been implemented since 1997, with only one form of BOT contract. Until 1998, the types of PPP contracts were expanded to 03 types: BOT, BTO, and BT. During that period, the legal documents did not have guidance on the selection of PPP investors. Despite some decrees or guiding circulars, there have been not enough legal elements for the model and the project implementation process. When applying them, they caused many inadequacies, generated many disputes, and exposed risks to both the public and private sectors [2].

2014-2019 period

In Vietnam, legal regulations on PPP investment were institutionalized in different legal documents such as: Law on Public Investment; Law on Bidding; Investment law; Land law, etc. and regulations on PPP have been agreed in the Government's decree. But at this stage, the investment rush has indicated that there were gaps, causing state property loss and lack of support from public due to lack of transparency of projects. Specifically [2]:

- Law on the use of development investment capital: The use of development investment capital of the State is only applied to a number of projects belonging to important industries and large economic programs with economic-social efficiency and capability of repaying loans such as developing clean water supply, waste treatment programs; or housing projects in large industrial parks, etc. Thefore, the laws on the use of development investment capital have been limited, proving weak and poor controlled ability of state management. They have not controlled well the financial input flow and the transparency of the capital operation process. Or it can be stated that the capital lending process and cost control are still inadequate, inconsistent, creating loopholes for some investors who have not enough resources, to circumvent the law, raising the project’s value to possess part of the capital, with the help of a number of corrupt competent authorities. Those activities caused loss and loss of trust of the society, the government, and good investors.

- Currently, Vietnam's Law on Public-Private Partnership (PPP) Investment was approved by the 14th National Assembly in June 2020, effective from January 2021 [6].

- There is a system of Decrees and Circulars to support the Laws. However, investment attraction is still weak although many projects have had a relatively long preparation duration. For instance, the highways along the National Highway 1 include 8 component projects. Only 3 of them can be successfully invested in BOT form. This proves the weakness, lack of professionalism in investment potential, financial capacity of Vietnamese investors, especially their transparency. Such assumption demonstrated by the following data [2]:

Example 1: In the period of 2011-2016, there were 69 transport projects invested in form of BOT contracts. All of them were designated contractors, of which 47 projects were allowed by the Prime Minister to appoint contractors; 21 bidding projects with only 1 investor; 01 bidding project was then switched to appointing contractor. Those caused suspicion among public and reduced investment attraction [1].

Some projects, after being accepted for appointing contractors, took a long time adjusting the total investment to finally select an investor. This did not satisfy the urgent requirements of the project. Contractor appointment method has limited the competitiveness, reduced the efficiency and transparency of the project. It also raised doubts for potential investors who lack of project information and relationships as well as professional expertise in transport construction.

Most of the projects organized the selection of investors but did not publish the project list, post information on the results of investor selection. This makes investors and the public lose their confidence and transparency is reduced [5].

Example 2:

In 2016, after inspecting BOT toll stations, the Ministry of Transport reported that the toll revenue during the monitoring period increased more than the equivalent period of the previous year.

The Ministry of Planning and Investment inspected the National Highway 1 expansion project, from km 1448 to km 1525. The project had an actual cost of 1,400 VND billion while the total investment is up to 2,700 VND billion. The difference is almost doubled. After inspection, duration for collecting fees must be reduced [4]. This proves that project appraisal and trial fee collection is just a formality, causing great loss to society. As a result, the phrase "success" is only true for certain groups of people. In the country scale, it is a "failure".

Example 3:

Regarding to Phap Van-Cau Gie BOT toll station, due to disagreements and lack of transparency in toll collection activity, there were internal complaints and act of accusing from shareholders. In 2016, the Ministry of Transport had to make a decision to inspect this station and found that the average revenue of 1.97 VND billion/day. In contrast, the investors reported that they collected only 582 VND million/day (less than 1/3 of the actual amount); so, the Inspector's conclusion was that they must reduce the toll collection duration [4].

After three above examples, we can conclude that:

- The ineffective supervisory and controlling of competent state agencies cause losses to the state and society who have to bear such burden due to certain interest groups.

- Supervision and appraisal activities from the preparation, implementation stages to the end of the investment and put into operation are still abandoned, causing increase in project value.

- The regulation violations in PPP form have created many loopholes such as appointing contractors, not disclosing the projects. This leads to the issue that investors could not get any information about the projects which created changes for interest groups [6].

In short, state management have not done well wit their models and tools, creating many risks, legal disputes, conditions for interest groups to manipulate, cause losses, and reduce investment attraction due to the lack of transparency in investment management. In project preparation and implementation, adjustments are required, especially in countries with unbalanced development of the economy at the macro-medium-micro scale [7].

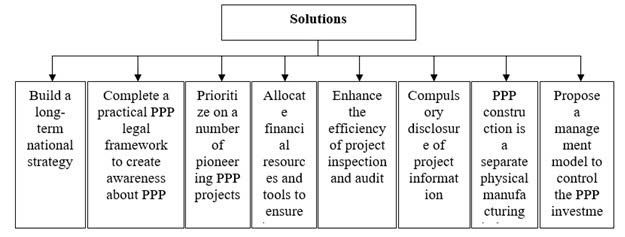

3. Solution system to complete the transport infrastructure investment model under the public-private partnership (PPP)form in Vietnam

Figure 1: Solutions for building transport infrastructure development model in Vietnam in public-private partnership (PPP) form

3.1. Build a national long-term PPP investment strategy with transportation as the foundation

There must be a transparent, consensus and balanced PPP investment strategy from the central to local levels to create a balance for developing economy in all three macro-medium-micro aspects. Quality acts as the foundation for the project success, ensuring socio-economic efficiency. Create breakthroughs in transportation, making it the driving forces to attract investment and promote other material production industries.

3.2. Complete the legal framework on PPP in accordance with practical circumstances in order to build the right insights and awareness about PPP investment

PPP investment method has been successfully applied by many countries. Although there have been some countries including Vietnam that have not been successful as expected for certain reasons. It can be affirmed that the legal system to promote PPP investment attraction in Vietnam as well as in some countries still have exposed shortcomings, gaps, not creating enough confidence to attract investors. Although the legal system on PPP investment in Vietnam has been gradually improved, it hase not given investors the right insights of PPP investment and their confidence about the existing legal corridor, especially the issue of risk sharing (if any) between the state and investors. Therefore, it is imperative to quickly complete the legal framework for PPP investment in Vietnam. Accordingly, better policies on profit and risk sharing between the State and investors are required. We also need to create incentives in bidding to select investors and other policies to enhance the attraction of private investment in transport infrastructure construction projects. The investors should feel confident that they act for benefits to society, the society also responds fairly to them [8].

3.3. Prioritizing on number of pioneering PPP projects to gain experience

Philosophical view "Theory needs to be proven through practice, taking practice to adjust the theory": To be successful in applying the PPP investment form, the state needs to decide on a number of projects that represent different economic sectors are pioneering. From those projects, we can gain experience from each stage of the projects, with contributions of experts, investors, the community, etc., as well as references of the success or failure of the same type of investment in the world. From there, we complete the legal framework, control model, capital structure, risk sharing, etc., to unitedly achieve the goal of successful PPP projects.

3.4. Allocate state financial resources to invest in PPP projects

In Vietnam, the financial resources of the State invested in PPP projects are not only a tool to support the project, but also to control input capital, ensuring the trust of the private investors/project enterprises on the proportion of state capital invested in the projects. The participation of state capital in the PPP project, together with the strengthening of the functions and responsibilities of the competent state agencies over the project, are the foundation for creating confidence for the community and investors regardting the accountability and transparency of the projects, contributing to the success of PPP projects. This shows that the state needs to form a separate capital flow, which is used as a counterpart capital mechanism for PPP projects right from the approval of medium-term capital sources.

3.5. Enhancing the efficiency of PPP project inspection and audit

From an investment perspective, the effectiveness projects mean that they must ensure socio-economic conditions, in order to determine the real value of the project, and prevent loss, waste from the survey, design, and construction stages, etc. causing an increase in the project capital. However, currently, the inspection of transport infrastructure PPP investment projects in Vietnam is still not timely. They perform inspection activities usually only when public opinion raises their complaints and when the project has been completed and is in the exploitation stage. Thus, the loosening of inspection and audit of PPP projects not only causes loss of cost, but also loss of quality, reduced project life, and loss of confidence in society. This proves that the role of the state management is too weak. While the legal system to control public investment has been relatively complete, but the inspection of PPP projects is not enough. Therefore, in order to increase investment in transport infrastructure under the PPP method, it is necessary to make an immediate adjustment including strengthening the inspection and audit activitties by competent state agencies on the basis of respect for the laws.

3.6. Compulsory disclosure of project information to attract PPP investors

Vietnam is only a middle-income country. There are very few large international corporations, so financial options are still based on the banking system using short-term loans, long-term loans, offering capital to customers. There are many risk factors affecting the foreign investment attraction with real financial potentials. Therefore, the information disclosure and transparency is very necessary. However, currently, the role of Vietnam's PPP management agency lacks a mandatory process to transparently disclose project information, information about participating investors who join the project. Therefore, investors with financial potentials, especially foreign investors, do not have access to information or have very little time to prepare resources, not to mention divergent interest groups hiding information. As a result, the projects follow the method of appointing contractors, easily causing financial loss and setting a negative precedent for investors, reducing investment attraction.

3.7. Building PPP as a separate physical production industry

In order to be successful in PPP investment projects, first of all, training must be given to build "PPP people". Accordingly, it means we have to build professional PPP management model in terms of operation with group of talents with deep PPP expertise and high responsibility. This, in the context of Vietnam, is absolutely not easy without a separate PPP industry, operating on a legal basis according to the law, with a sanctioning system, a separate cash flow as a financial instrument to actively control PPP activities for all physical manufacturing industries.

3.8. Proposing a management model to control the PPP transport infrastructure investment in Vietnam

The current management model of Vietnam's PPP investment is completely unprofessional from the central to local levels. Even in industries with very large investments that account for over 70% of the country's total PPP investment such as the Ministry of Transport, it also failed to show its role, especially in the field of investment attraction, investment guidance, investment control organization. It is urgent to build a model, with all levels, implemented from the central to local levels on the basis of responsibility and professionalism to be successful in the PPP investment.

Therefore, consulting organizations must be selected by competent state management agencies through bidding, except for projects proposed by investors. The investors are responsible for costs, pre-feasibility – feasibility preparation and those will be added into total investment. However, the state management agency is responsible for appraising all aspects of progress, quality, cost, risks, etc.

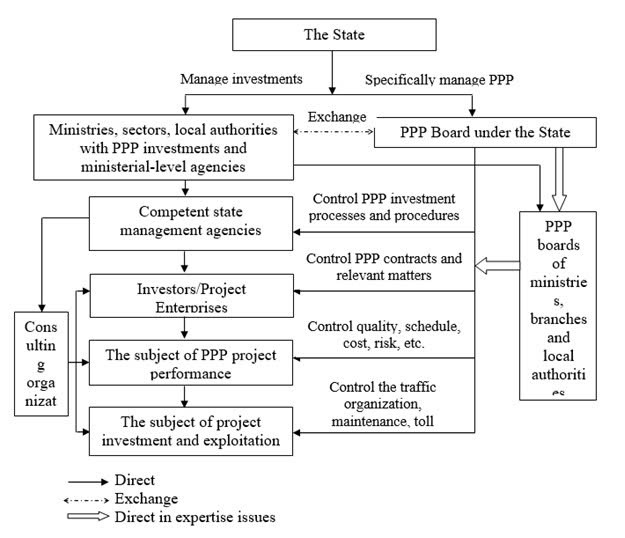

Figure 2: Model of managing and supervising investment in transport infrastructure projects in PPP form in Vietnam

With the above model (Figure 2), it shows that the state needs a specialized agency under the Government (PPP Board under the Government) and specialized agencies under ministries - branches – local authorities to control both competent state agencies, investors/project enterprises, consulting contractors, project construction workers and entities that organize PPP project exploitation. This is expected to minimize legal loopholes, increasing the transparency of the project, creating investment attraction and achieving the national goals.

REFERENCES

1. The Ministry of Transport (2018), "Document No. 10 225/12 09 BGTVT 2018 on the implementation of investment projects under PPP of the Ministry of Transport."

2. The Ministry of Planning and Investment (2019), "Recommended Investment Law in the form of public-private partnership PPP", submitting to the National Assembly Standing Committee.

3. The Government (2015), "Decree No. 15/2015 / ND-CP dated 14 May 02 2015 on investment in the form of public-private partnerships".

4. Le Huong Linh et al (2018), "The risk of the investment for state management in the form of public-private partnership (PPP) road transport sector: statement and policy solutions", scientific thesis of the Ministry of Planning and Investment.

5. The National Assembly of the Socialist Republic of Vietnam (2017), "Reports on monitoring the implementation of investment projects under the public-private partnership mode PPP".

6. The National Assembly of Vietnam (2020), "Investment Law under public-private partnership approach."

7. Manh Tuong Le, et al (2021), “Application of quality planning and construction project to optimize product quality”, Istrazivanja i za privredu projektovanja Journal of Applied Engineering Science.

8. Le Phi Vu, Le Manh Tuong, Le Van Thuc (2021), "Risk Management of Projects of Tien Giang Province Transportation in Climate Change Conditions", International Journal of Scientific Research in Civil Engineering 2021 | IJSRCE | Volume 5 | Issue 3 | ISSN: 2456-6667